- 651 N Broad St Suite 206 Middletown , DE 19709 US

- +1 (302) 329-4458

The present value of an annuity is based on a concept called the time value of money — the idea that a certain amount of money is worth more today than it will be tomorrow. This difference is solely due to timing and not because of the uncertainty related to time. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

As mentioned, an annuity due differs from an ordinary annuity in that the annuity due’s payments are made at the beginning, rather than the end, of each period. Using the same example of five $1,000 payments made over a period of five years, here is how a PV calculation would look. It shows that $4,329.48, invested at 5% interest, would be sufficient to produce those five $1,000 payments. In financial accounting this term refers to the amount of debt excluding interest.

For example, you’ll find that the higher the interest rate, the lower the present value because the greater the discounting. Where i is the interest rate per period and n is the total number of periods with compounding occurring once per period. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. Email or call our representatives to find the worth of these more complex annuity payment types. That’s why an estimate from an online calculator will likely differ somewhat from the result of the present value formula discussed earlier. In just a few minutes, you’ll have a quote that reflects the impact of time, interest rates and market value.

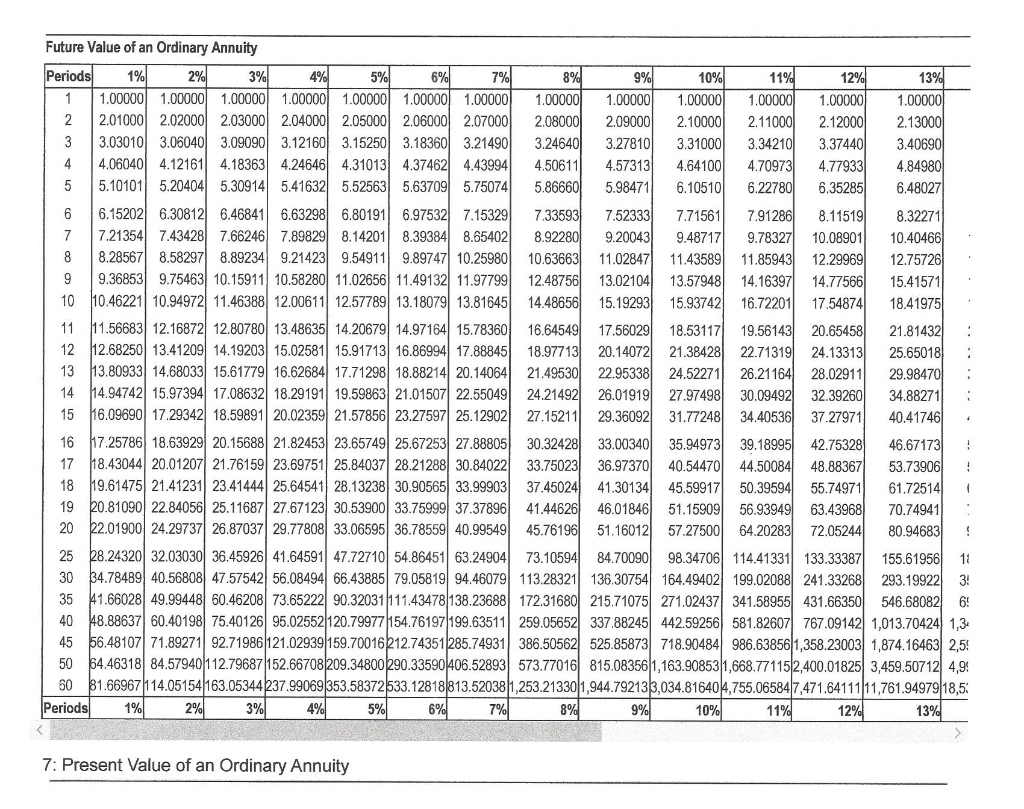

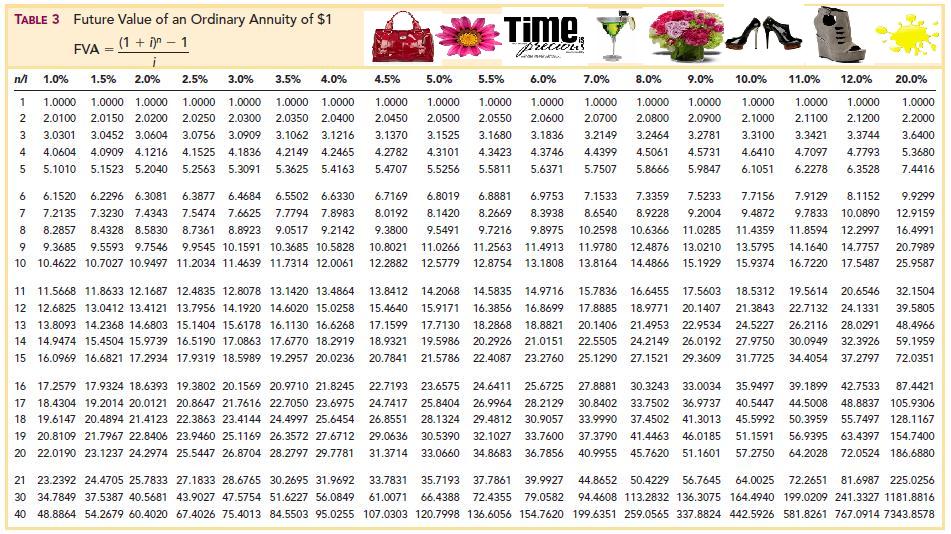

Entering these values in an equation yields the present value of an annuity. By using the time value of money concept and a few easy calculations, you’ll be able to conceptually pull back all those future payments to understand what they’re worth now. Annuity tables are visual tools that help make otherwise complex mathematical formulas much easier to calculate.

In order to understand and use this formula, you will need specific information, including the discount rate offered to you by a purchasing company. According to the Internal Revenue Service, most states require factoring companies to disclose discount rates and present value during the transaction process. According to the concept of the time value of money, receiving a lump-sum payment in the present is worth more than education tax credits and deductions you can claim in 2020 receiving the same sum in the future. The present value of an annuity is the present cash value of payments you will receive in the future. Now as that you know all the financial terms appearing in this calculator, let’s do a quick example of how the annuity formulas can be applied. Although this approach may seem straightforward, the calculation may become burdensome if the annuity involves an extended interval.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For example, if $1,000 is deposited in an account earning interest of 6% per year the account will earn $60 in the first year. In year two the account balance will earn $63.60 (not $60.00) because 6% interest is earned on $1,060. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. If you’re interested in buying an annuity, a representative will provide you with a free, no-obligation quote.

As with the calculation of the future value of an annuity, we can use prepared tables. If you own an annuity, the present value represents the cash you’d get if you cashed out early, before any fees, penalties or taxes are taken out. You can usually find the current present value of your annuity on your policy statements or your online account. Present value of an annuity refers to how much money must be invested today in order to guarantee the payout you want in the future. The future value should be worth more than the present value since it’s earning interest and growing over time.

On the other hand, an “ordinary annuity” is more so for long-term retirement planning, as a fixed (or variable) payment is received at the end of each month (e.g. an annuity contract with an insurance company). Having $10,000 today is better than being given $1,000 per year for the next 10 years because the sum could be invested and earn interest over that decade. At the end of the 10-year period, the $10,000 lump sum would be worth more than the sum of the annual payments, even if invested at the same interest rate.

You’ve owned the annuity for five years and now have two annual payments left. While this example is straightforward because it involves round numbers and a single payment period, the calculations can become more complex when dealing with multiple payments over time. You can then look up the present value interest factor in the table and use this value as a factor in calculating the present value of an annuity, series of payments. Annuity due refers to payments that occur regularly at the beginning of each period. Rent is a classic example of an annuity due because it’s paid at the beginning of each month.